This Is Why a Stock Market Crash Could Be Ahead

Investor sentiment seems to be taking a turn for the worse. Don’t take it lightly, whatsoever. It foretells a stock market crash.

Before going into any details, here’s some background.

Between 2012 and 2017, nothing seemed to matter to investors. Bad news was taken as good news, and good news was taken as great news. People bought stocks regardless. Earnings, the most basic reason why we see stock prices rise and why we see stock market crashes, didn’t matter to investors.

Between 2015 and 2016, earnings of companies on the S&P 500 Index were falling. It didn’t matter to investors; every dip in the stock market was followed by a buying spree.

Something has changed since the beginning of 2018, however.

All of a sudden, investors started taking every piece of news as bad news. Economic data doesn’t matter to them anymore. Even great earnings don’t matter to them, it seems. Mark my words: this is dangerous. It tells us that they are finding excuses to sell, and that we could see massive losses ahead if there’s actual bad news.

Please look at the following three stock charts; they are making a solid case for investor sentiment changing and a stock market crash looming.

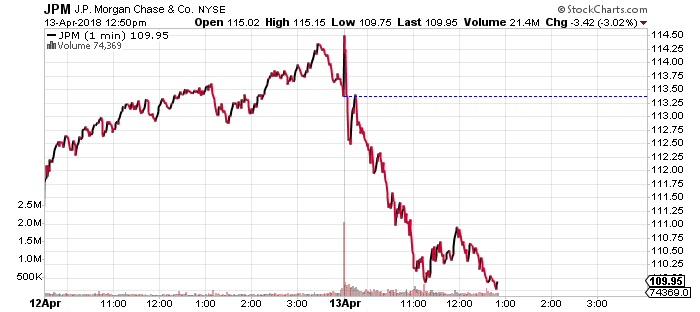

1. JPMorgan Chase & Co.

JPMorgan Chase & Co. (NYSE:JPM), one of the biggest banks in the U.S., reported profits of $8.7 billion in the first quarter of 2018. This is 35% higher than in the same period year-over-year, and an all-time record earnings for the bank. JPMorgan reported solid operations for the first quarter and provided an upbeat outlook. (Source: “JPMorgan Reports Record Earnings, Boosted by Tax Law,” The Wall Street Journal, April 13, 2018.)

What happened to the JPM stock price? It dropped three percent from the previous day. It’s currently down roughly 7.5% from its highs in late February.

Chart courtesy of StockCharts.com

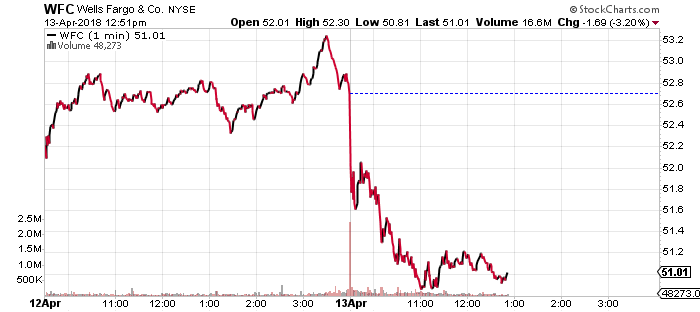

2. Wells Fargo & Co

Wells Fargo & Co (NYSE:WFC) reported profits of $5.5 billion, or $1.12 per share, in the first quarter of 2018. This was six percent higher than the same period a year ago. It was also higher than what the Wall Street analysts were forecasting. (Source: “Wells Fargo quarterly profit rises 6 percent,” Reuters, April 13, 2018.)

Despite this, WFC stock tumbled 3.2% after earnings. It now trades 22% below its highs in early February.

Chart courtesy of StockCharts.com

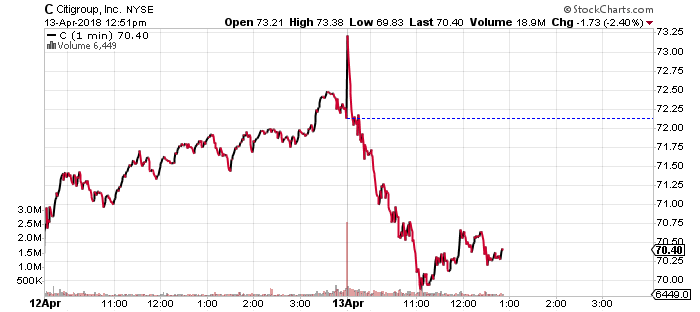

3. Citigroup Inc

Citigroup Inc’s (NYSE:C) financial performance was a grand slam hit as well. The bank’s first-quarter net income jumped by 13% year-over-year. It also beat Wall Street analysts’ estimates. (Source: “Citigroup profit beats on strength in consumer banking, equity trading,” Reuters, April 13, 2018.)

After that positive earnings announcement, however, C stock dropped 2.4%. Now Citigroup stock is down by more than 12% from its highs in late January.

Chart courtesy of StockCharts.com

Stock Market Outlook: We Could See a Lot More Volatility

Dear reader, we currently have the Federal Reserve raising interest rates. Rising interest rates are usually considered good for bank stocks. Investors aren’t buying this idea though; they are selling bank stocks, regardless.

Looking at the bigger picture, in the last quarter of 2017, we saw investors sell companies that reported better-than-expected earnings. We could see a lot of that during the first-quarter 2018 earnings season. This is a very clear sign that suggests that investor sentiment could be changing.

Bank stocks tumbling as those banks report solid earnings is a signal that a stock market crash could be brewing. Be very careful if you own stocks.